Financial Wellness: Developing Healthy Spending Habits

Image Credits: iStock

Let's talk about something we all love to have and sometimes hate managing because it can feel like a never-ending puzzle — Finances.

It is easy to get caught up in the whirlwind of expenses, bills, and credit cards and lose sight of our long-term financial well-being. That is why we are here to lend a helping hand and share valuable insights and practical tips to empower you on your financial journey.

We believe financial wellness is not just about making money but about building a solid foundation for a fulfilling and stress-free life. This blog will explore how to develop healthy financial habits to help you achieve that sweet balance between living your best life and keeping your bank account happy.

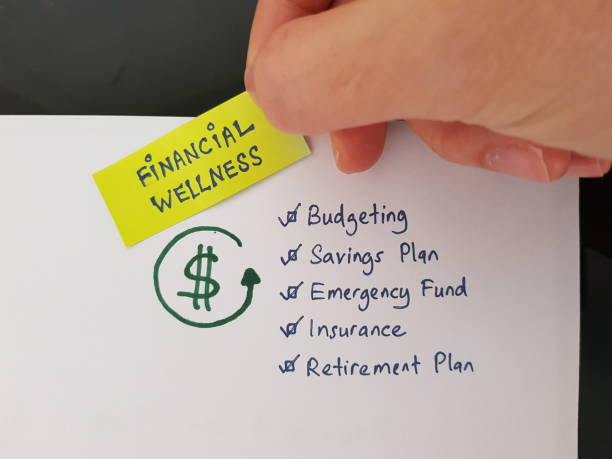

Understanding Financial Wellness

Financial wellness is the state of having a healthy relationship with money. It involves effectively managing your income, expenses, and investments to achieve your financial goals. Being financially well means

- Reducing Financial Stress

- Having Control Over Your Finances

- Being Able To Make Informed Decisions

It is about finding a balance between your current needs and future aspirations. Understanding the importance of financial wellness and improving your financial habits can pave the way for a more secure and prosperous future. It is time to take charge of your financial well-being and develop healthy spending habits.

Now we will navigate the practical tips, tricks, and strategies to develop healthy financial habits and pave the way to a brighter financial future.

Tracking Your Expenses

Tracking your expenses is a fundamental step towards developing healthy spending habits. By keeping a record of where your money goes, you gain valuable insights into your spending patterns and identify areas where you can cut back.

- Create a budget that outlines your income and categorizes your expenses: housing, transportation, groceries, or entertainment.

- Use online budgeting tools or simple spreadsheets to stay organized.

![]()

Image Credits: Stock

Tracking your expenses allows you to make informed decisions about your spending, prioritize your financial goals, and ensure that you are living within your means. It is a powerful tool for financial awareness and control.

Differentiating between Needs And Wants

A key aspect of developing healthy spending habits is understanding the difference between needs and wants.

● Needs

Needs are essential items necessary for survival, such as food, shelter, and healthcare.

● Wants

Wants, on the other hand, are things we desire but can live without.

It is essential to pause and reflect before making a purchase, asking ourselves if it is a genuine need or a fleeting want. By distinguishing between the two, we can prioritize our spending, make wiser financial choices, and avoid impulsive purchases. This practice promotes mindful spending and helps us align our financial decisions with our long-term goals.

Saving For Emergencies

Building an emergency fund is a crucial component of financial wellness. Life is unpredictable, and having a safety net can provide peace of mind and protect your financial well-being. Aim to save at least three to six months' worth of living expenses in a separate savings account.

Image Credits: iStock

Start small and consistently contribute to your emergency fund over time. Set a realistic goal and make it a priority in your budget. An emergency fund allows you to navigate unexpected circumstances, such as job loss, medical expenses, or car repairs, without resorting to high-interest debt or financial stress.

By saving for emergencies, you invest in your financial security and take a proactive step towards a more stable future.

Comparison Shopping

Comparison shopping is a powerful tool in your quest for financial wellness. Before making a purchase, take the time to compare prices and explore different options.

With online platforms and mobile apps, comparing prices across various retailers is easier than ever. Look for deals, discounts, and promotions that can save you money. However, it is not just about finding the lowest price; quality and customer reviews are equally important.

Comparison shopping lets you make informed decisions, ensuring you get the best value for your money. Whether you are shopping for groceries, clothing, electronics, or even services, make it a habit to compare prices and research before making a purchase.

Image Credits: iStock

Over time, the savings from comparison shopping can add up significantly, allowing you to stretch your dollars further and achieve your financial goals more efficiently. Therefore, before you buy, compare and make smart choices that align with your budget and priorities.

Embracing Frugality

Embracing frugality does not mean living a life of deprivation or sacrificing your happiness. It is about being mindful of your spending and finding ways to save without compromising your quality of life.

Here are some tips for embracing frugality and developing healthy spending habits:

● Cook Meals At Home

Eating out can be expensive. Embrace the joy of cooking and experiment with homemade meals. Not only will you save money, but you will also have control over the ingredients and portion sizes.

● Pack lunches

Instead of buying lunch every day, pack your own. It is cost-effective and allows you to choose healthier options while reducing waste from takeout containers.

● Explore Free Activities

Take advantage of your community's many free recreational activities, such as hiking, biking, visiting local parks, or attending community events.

● Buy Pre-Owned Or Borrow

Consider buying pre-owned items or borrowing from friends and family when possible. You can find great deals on second-hand items that are still in good condition.

Image Credits: Pexels

● Prioritize Experiences Over Things

Focus on creating memorable experiences rather than accumulating material possessions. Plan activities with loved ones that do not require spending much money.

By embracing frugality, you will discover the joy of simplicity and the satisfaction of saving money. Small changes in your daily habits, such as reducing unnecessary expenses and finding creative alternatives, can add significant savings over time.

Embracing frugality allows you to prioritize your financial goals, reduce unnecessary spending, and develop a healthy relationship with money. It is about making intentional choices that align with your values and long-term aspirations. Therefore, do not be afraid to embrace frugality and unlock its benefits to your financial wellness journey.

Avoiding Impulse Buying

Impulse buying can be a significant obstacle on the path to financial wellness. Those tempting displays, flashy advertisements, or limited-time offers can lead us to make unplanned purchases that strain our budgets.

To overcome impulse buying, create a 24-hour waiting period before making non-essential purchases. This cooling-off period allows you to evaluate whether the item aligns with your financial goals and if it is a well-thought-out decision.

Image Credits: Freepik

Additionally, practice mindful shopping by making a shopping list and sticking to it. Avoid shopping when you are feeling stressed, bored, or emotional, as these states can make you more susceptible to impulse purchases.

By consciously resisting the urge to buy on impulse, you regain control over your spending and ensure your hard-earned money is allocated wisely. Remember, thoughtful and intentional purchases are key to developing healthy spending habits and achieving long-term financial wellness.

Also Read: Your Guide To Use 30 Day Rule To Avoid Overspending

Automating Savings

Automating your savings is a powerful strategy for developing healthy spending habits and achieving financial wellness. Set up automatic transfers from your checking account to your savings account regularly. Treating your savings like any other monthly bill ensures that you consistently save money without thinking about it.

Image Credits: Freepik

By automating your savings, you remove the temptation to spend the money before saving it. It is a convenient and effective way to build your savings effortlessly. Start small if needed and gradually increase the amount over time. As your savings grow, so do your financial security and ability to reach your financial goals.

Automating your savings is a proactive step that helps you prioritize saving and makes it a non-negotiable part of your financial routine. Take advantage of technology to make saving a seamless and integral part of your financial journey.

Educating Yourself On Personal Finance

Educating yourself on personal finance is critical to developing healthy spending habits and achieving financial wellness. Take the time to learn about budgeting, investing, debt management, and other financial topics.

Read books, follow reputable financial blogs, and attend workshops or webinars. Organizations like the Financial Consumer Agency of Canada and local credit unions offer free resources to improve your financial literacy.

Image Credits: iStock

By gaining knowledge and understanding, you can

- Make Informed Decisions About Your Finances

- Set Realistic Goals

- Develop A Long-Term Financial Plan

Empower yourself with financial knowledge and watch as it transforms your relationship with money, paving the way for a more secure and prosperous future.

Seeking Professional Advice

Sometimes, seeking professional advice is essential for developing healthy spending habits and achieving financial wellness. Certified financial planners or advisors can provide expert guidance tailored to your circumstances. They can help

- Assess Your Financial Situation

- Set Realistic Goals

- Create A Personalized Plan

Professional advisors have the knowledge and expertise to navigate complex financial matters and offer objective advice. Their insights can help you make informed decisions, optimize your investments, and manage debt effectively.

Do not hesitate to seek professional advice if you need help with budgeting, retirement planning, or investment strategies. Working with a financial advisor can provide valuable support on your journey to financial wellness.

Related: What You Need To Know Before You Hire A Financial Advisor Or Planner

Teaching Kids About Money

Image Credits: iStock

Instilling financial literacy in children is crucial for their future financial wellness.

- Teach them the basics of money management from an early age.

- Encourage saving by providing piggy banks or savings accounts and explaining the importance of delayed gratification.

- Involve them in family budget discussions and shopping trips to impart lessons on needs versus wants.

- Teach them about earning money through age-appropriate chores or part-time jobs, and discuss the importance of giving and charitable contributions.

By teaching kids about money, we equip them with essential skills to make responsible financial decisions and develop healthy spending habits from a young age.

Final Takeaway

Developing healthy spending habits is not about depriving ourselves or missing out on the fun stuff. It is about gaining control over our financial lives, reducing stress, and setting ourselves up for a brighter future.

Here is the deal: it is time to take action! Start implementing these tips today and watch your financial wellness soar.