Credit Tip Tuesday #3: All About Credit Utilization

Now that you are aware of the 5 factors (listed below) that help build your credit, it’s time to understand how credit utilization helps you build your credit.

Today, we will go through the following important questions

- What is credit utilization & how is it calculated?

- What is a good credit utilization ratio?

- How credit utilization helps build your credit score?

- How to improve your credit utilization?

- What can hurt your credit utilization ratio?

What is credit utilization & how is it calculated?

Credit utilization (or simply put, credit card utilization) is the amount of available credit you use at any given time.

How is credit utilization ratio calculated?

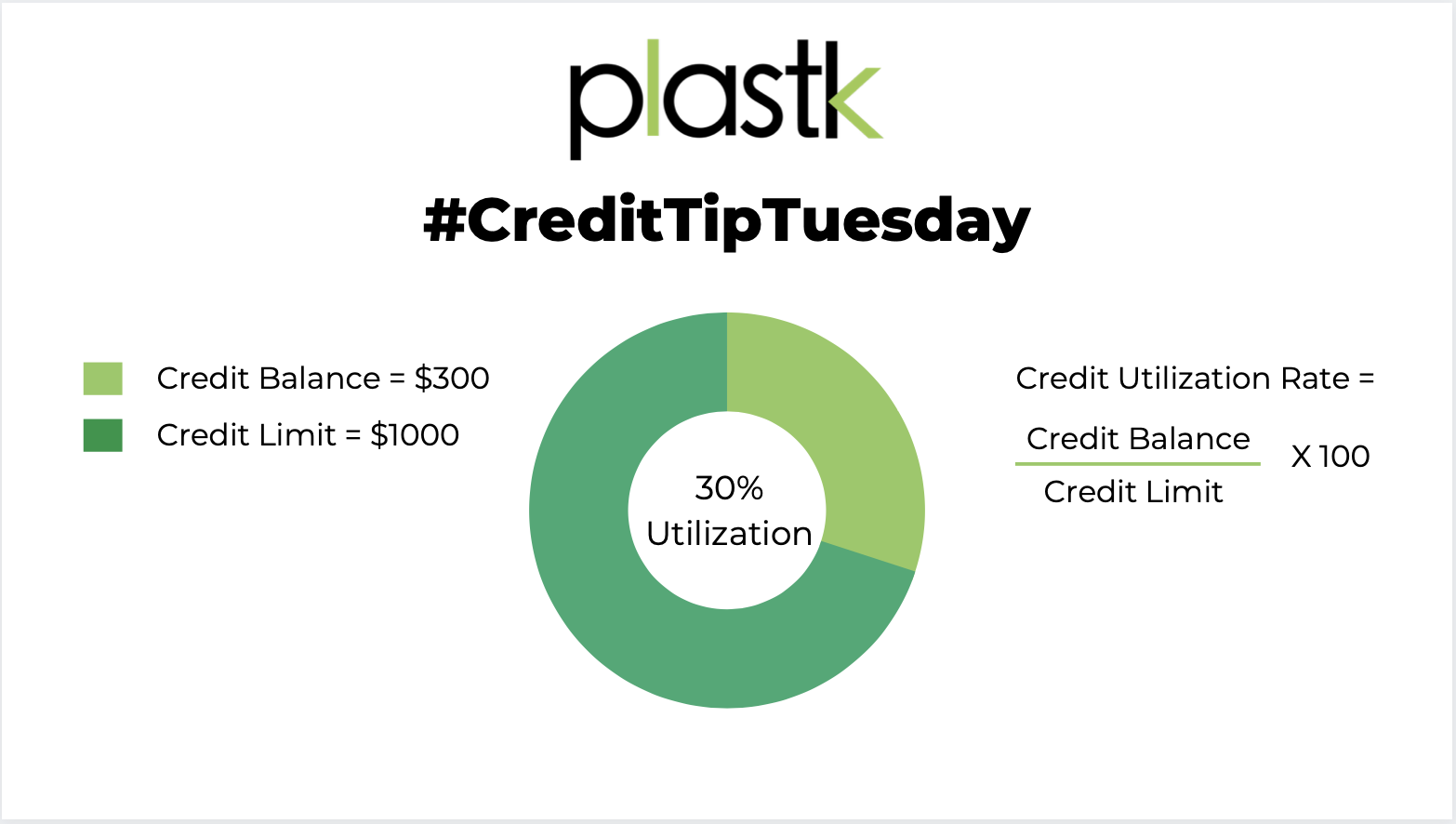

Credit utilization rate is the ratio of your outstanding credit card balances to your credit card limit. It tells you how much of the available credit you are using. For example - if your balance is $300 and your credit limit is $1,000, then your credit utilization for that credit card is 30%

You can calculate your credit utilization ratio by simply dividing your credit card balance by your credit limit, then multiplying by 100.

For this example, it’s (300/1000)*100 = 30%

What is a good credit utilization ratio?

A credit utilization ratio below 30% is considered very good. So, try to use not more than 30% of your available credit on your credit card.

How credit utilization helps build your credit score?

The lower your credit utilization percentage, the better. A low credit utilization shows that you're only using a small amount of the credit that's been loaned to you and this improves your credit score.

Credit utilization ratio is not real time because it is calculated on the basis of the most recent information posted on your credit report- which is on the basis of your billing cycles. Hence, your credit score may not reflect the most recent transactions made with your credit card balance and credit limit.

How to improve your credit utilization?

- Avoid debt - Always try to pay more than the minimum each month

- Lower your spending - If you know, you won’t be able to pay off, try not to overspend

- Increase your credit limit - Your credit card issuer should be able to increase your credit limit based on their terms & conditions

- Get your profile updated - Call up your credit reporting agency (Equifax, TransUnion and Experian) and get your profile updated with the recent changes

What can hurt your credit utilization ratio?

Do not cancel your credit card even if you are not using it. This is because when you cancel a credit card, you lower your available credit. This would increase your credit utilization ratio and have a negative effect on your overall credit score.

To apply for a Plastk Secured Credit Card click here. For more information visit our website at Plastk.ca

Disclaimer: The content provided on the Plastk Financial Inc. Blog is information to help Canadians become financially literate and learn about credit. Plastk is not responsible for building or ruining an individual's credit score or credit rating. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment, credit inquiries, and all other decisions should be made, as appropriate, only with guidance from a qualified professional.