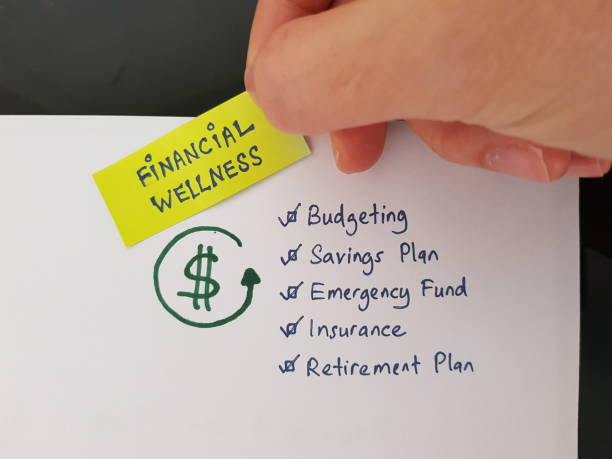

Strategies For Managing Financial Stress And Worry

Image Credits: iStock

We get it – finances can sometimes feel like a wild roller coaster ride, filled with ups, downs, and plenty of heart-pounding twists, especially when unexpected expenses pop up or credit card debt starts to accumulate.

But fret not!

In this friendly little corner of the internet, we will be diving deep into the world of personal finance and sharing some practical tips and strategies to help you navigate these choppy waters with a sense of calm and control.

We understand that dealing with financial stress can be challenging, but trust us, there is always a way forward. We aim to empower you with the knowledge and tools to navigate financial ups and downs confidently and efficiently.

Let's conquer financial stress together!

Assess Your Financial Situation: Taking Stock Of Your Finances

Image Credits: iStock

Before we can tackle financial stress, it is essential to assess your current financial situation. Understanding where you stand can create a solid foundation for improvement.

Start by reviewing your income sources, including salary, investments, and other earnings. Then, evaluate your expenses, categorizing them into essential and discretionary items. Further, create a budget to track your monthly spending and identify areas for improvement. This helps you prioritize your financial goals and make informed decisions.

Now, consider your debts and savings, and determine if adjustments are needed. By assessing your financial situation, you lay the foundation for a healthier financial future, enabling you to make positive changes and reduce stress.

Build An Emergency Fund: Shielding Yourself From Financial Curveballs

Image Credits: Freepik

One of the best ways to alleviate financial stress is by establishing an emergency fund. Life is full of unexpected curveballs, and an emergency fund serves as a financial cushion when unexpected expenses, such as medical bills or home repairs, arise. It prevents you from going into debt or dipping into your savings meant for other purposes, giving you peace of mind.

To build one, follow these steps:

● Set A Savings Goal

Start by setting a goal of saving three to six months' worth of your essential expenses. This will provide you with a comfortable buffer in case of unexpected events or job loss.

Further, you must start small and gradually increase savings: Building an emergency fund takes time and consistent effort. Start by setting aside a small portion of your income each month and gradually increase the amount as your financial situation improves.

● Automate Your Savings

Make it easier to save by automating transfers from your checking account to a dedicated savings account. Treat your savings as a regular bill that must be paid!

Keep your emergency fund in a separate savings account to avoid using it for non-emergency expenses. This will make it less tempting to dip into it for everyday expenses.

Tackle Debt: Breaking Free From The Weight Of Borrowing

Image Credits: Stock

Tackling debt is a crucial strategy for managing financial stress and worry. Debt can feel like a heavy burden, but there are ways to break free from it.

Debt management strategies include:

- Start by assessing your debt situation, taking note of outstanding balances and interest rates.

- Prioritize your debts, focusing on high-interest ones first.

- Create a debt repayment plan using the snowball method (starting with the smallest debt) or the avalanche method (targeting high-interest debts).

- Make consistent payments, even if small, and consider allocating extra funds towards debt reduction.

As you chip away at your debts, you will experience a sense of accomplishment and a decrease in financial stress. Breaking free from the weight of borrowing will provide you with the financial freedom and peace of mind you deserve.

Seek Financial Education: Empowering Yourself With Knowledge

Image Credits: iStock

Financial literacy is empowering. By increasing your knowledge and understanding, you can make informed decisions and reduce financial stress.

Here are some ways to boost your financial education:

● Attend Workshops And Webinars

Take advantage of free or affordable workshops and webinars offered by community organizations, libraries, and financial institutions. These educational sessions cover various personal finance topics, empowering you with knowledge and practical tips.

● Utilize Online Resources

Access valuable information from trusted sources like the Financial Consumer Agency of Canada (FCAC) and the Canadian Securities Administrators (CSA). These websites provide budgeting, saving, investing, and retirement planning resources, allowing you to enhance your financial literacy at your own pace.

● Read Books And Blogs

Explore personal finance books and blogs written by experts in the field. They offer insights, strategies, and real-life examples to help you navigate financial challenges and make informed decisions.

● Join Online Communities

Engage in online forums, and communities focused on personal finance. Interact with like-minded individuals, ask questions and share experiences. Learning from others can provide valuable perspectives and practical advice.

● Take Online Courses

Consider enrolling in online courses specifically designed to improve your financial literacy. Many platforms offer courses on topics like budgeting, investing, and money management, allowing you to learn at your own pace and convenience.

Practice Mindful Spending: Making Your Money Work for You

Image Credits: iStock

Mindful spending is a powerful strategy for managing financial stress and worry. It involves being intentional and conscious about how you allocate your money. This way, you gain a greater sense of control over your finances, reduce unnecessary stress, and make your money work for you.

Remember, every dollar you save today is a step towards a more secure and worry-free financial future.

Spending mindfully can be done in the following ways:

● Define Your Priorities

Determine your financial goals and align your spending with what matters most to you. By understanding your priorities, you can allocate your money accordingly.

● Differentiate Between Needs And Wants

Before making a purchase, ask yourself if it is a necessity or a desire. Consider alternative, more affordable options and avoid impulsive buying.

● Comparison Shop

Use online tools and resources to compare prices and find the best deals. Loyalty programs and cashback apps can also help you save money on purchases.

Explore Government Assistance Programs: Utilizing Available Support

Image Credits: Freepik

Exploring government assistance programs is valuable for managing financial stress and worry. In Canada, there are various programs designed to provide temporary financial relief during challenging times. Stay informed about programs like

- Canada Emergency Response Benefit (CERB),

- Employment Insurance (EI)

- Canada Child Benefit (CCB)

that may be applicable to your situation. Additionally, check your provincial government's website for specific support programs available in your region.

These programs can provide crucial assistance in times of need, helping to alleviate financial stress and worry. Understanding the eligibility criteria and application processes will ensure you can access the support you are entitled to.

Remember, these programs exist to support Canadians, so do not hesitate to utilize the available resources when necessary.

Seek Professional Guidance: Finding Support on Your Financial Journey

Image Credits: Freepik

When managing financial stress and worry, seeking professional guidance can make a world of difference. Certified financial planners, accountants, and credit counselors can provide expert advice tailored to your specific situation.

- A certified financial planner can help you develop a comprehensive financial plan, set realistic goals, and navigate complex financial matters.

- Accountants can guide tax planning, maximizing deductions, and ensuring compliance with tax regulations.

- Non-profit credit counseling agencies can assist with debt management and repayment strategies, offering personalized advice to improve your financial situation.

Do not hesitate to reach out for help when needed. Professionals are there to support you on your financial journey, providing valuable insights and strategies to alleviate stress and achieve financial well-being.

Practice Self-Care: Nurturing Your Well-Being Amid Financial Challenges

Managing financial stress and worry involves more than just numbers and budgets; it is crucial to prioritize self-care. Taking care of your mental and emotional well-being is essential during challenging financial times.

- Engage in activities that help you relax and unwind, such as exercise, spending time in nature, or pursuing hobbies you enjoy.

- Practice mindfulness or meditation to calm your mind and reduce anxiety.

- Nurture your relationships by spending quality time with loved ones.

- Set boundaries between work and personal life to ensure a healthy balance.

- Remember to be kind to yourself and practice self-compassion.

- Take breaks when needed and seek support from friends, family, or professionals.

Prioritizing self-care allows you to build resilience, maintain a positive mindset, and face financial challenges with a greater sense of well-being.

Summary

Phew! We have covered much ground in our exploration of strategies for managing financial stress and worry. We hope you are feeling more empowered and equipped to take charge of your financial well-being. Remember, managing your money does not have to be a daunting task. You can conquer financial stress and worry with the right mindset and practical tips.

So, let's do a quick recap: Assess your financial situation, build that emergency fund, tackle your debt head-on, seek financial education, practice mindful spending, explore government assistance programs, and do not hesitate to seek professional guidance when needed. And above all, remember to take care of yourself along the way.

Start implementing these strategies and watch your financial well-being flourish. Here is to a future of financial peace and a life free from the burden of money worries!